In support of future airport planning, AiQ has visually represented this year’s UK airport activity from January to April 2021. Our airport planners modelled the Civil Aviation Authority (CAA) monthly activity statistics on ATMs, passengers, and Cargo for 2021 for 51 UK airports. To highlight the dramatic effect COVID-19 has had on the aviation industry we include comparisons from 2019 and 2020. Understanding how the activity is changing month by month allows airports to flexibly plan their operations to passenger forecasts and prepare for the summer months which is usually the peak season for airports. Will passenger and ATM traffic continue to rise? We shall report on the summer months as CAA publish their data.

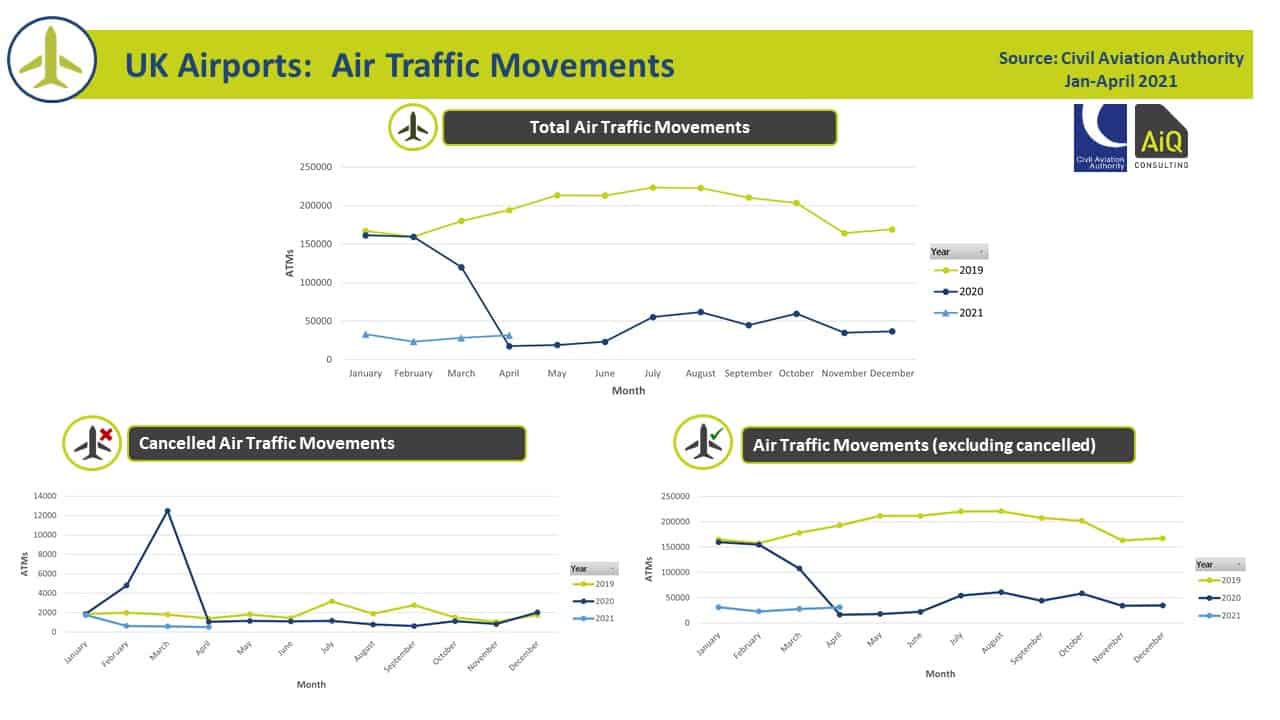

Air Traffic movements (ATMs) Jan-April 2021

The total Air Traffic Movement (ATM) graph above shows activity levels in Q1 2021 were 3,346,118, down 95% compared to Q1 in 2019. Whilst there was a dip in February 2021 in cancelled flights due to the UK national lockdown, total ATMs shows a more positive upward trend from March into April.

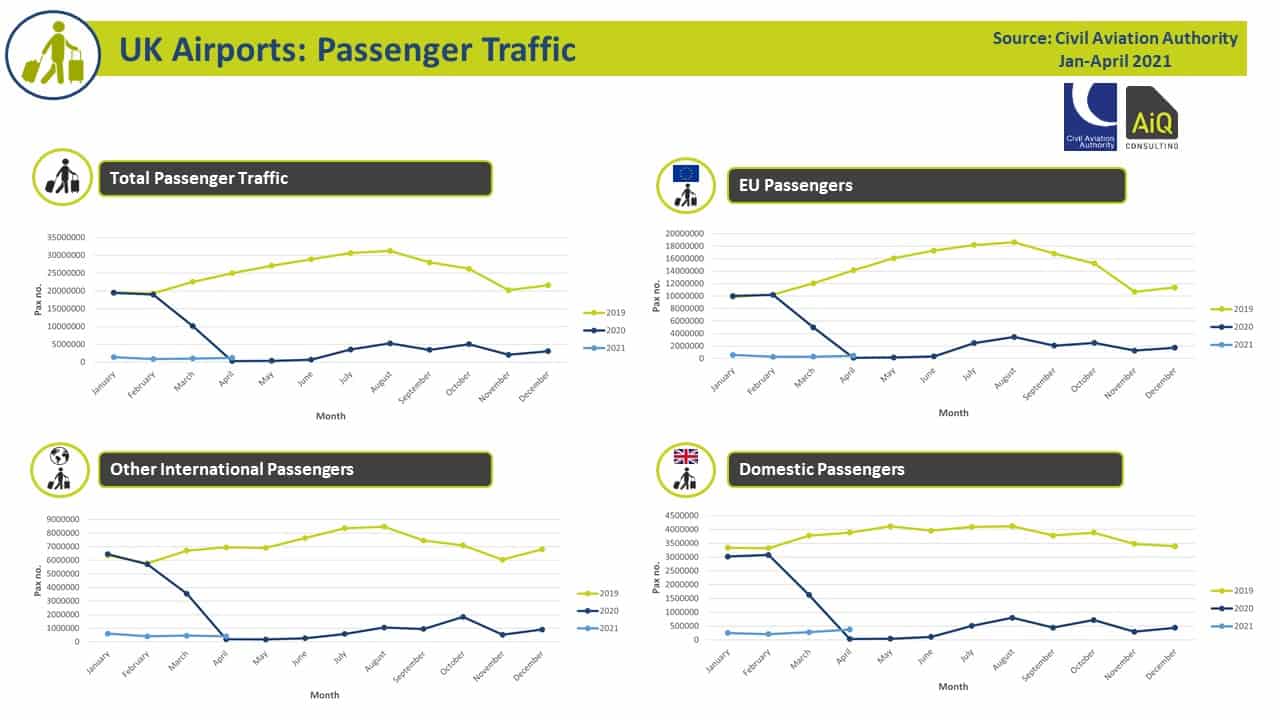

UK Airport Passenger Traffic Jan – April 2021

Passenger traffic follows a similar pattern to ATMs. In Q1 2021, only 2,423,971 passengers travelled through UK airports, down 96% compared to Q1 in 2019.

In mid-April 2021, the UK government announced the discovery of the Indian COVID variant in Britain. India was placed on the red list banning travellers from the country entering the UK at the end of April. This impact can be seen in the ‘other international passengers’ graph with an 11% decline in passengers in April. Whilst domestic passengers increased by 25% in April since the previous month.

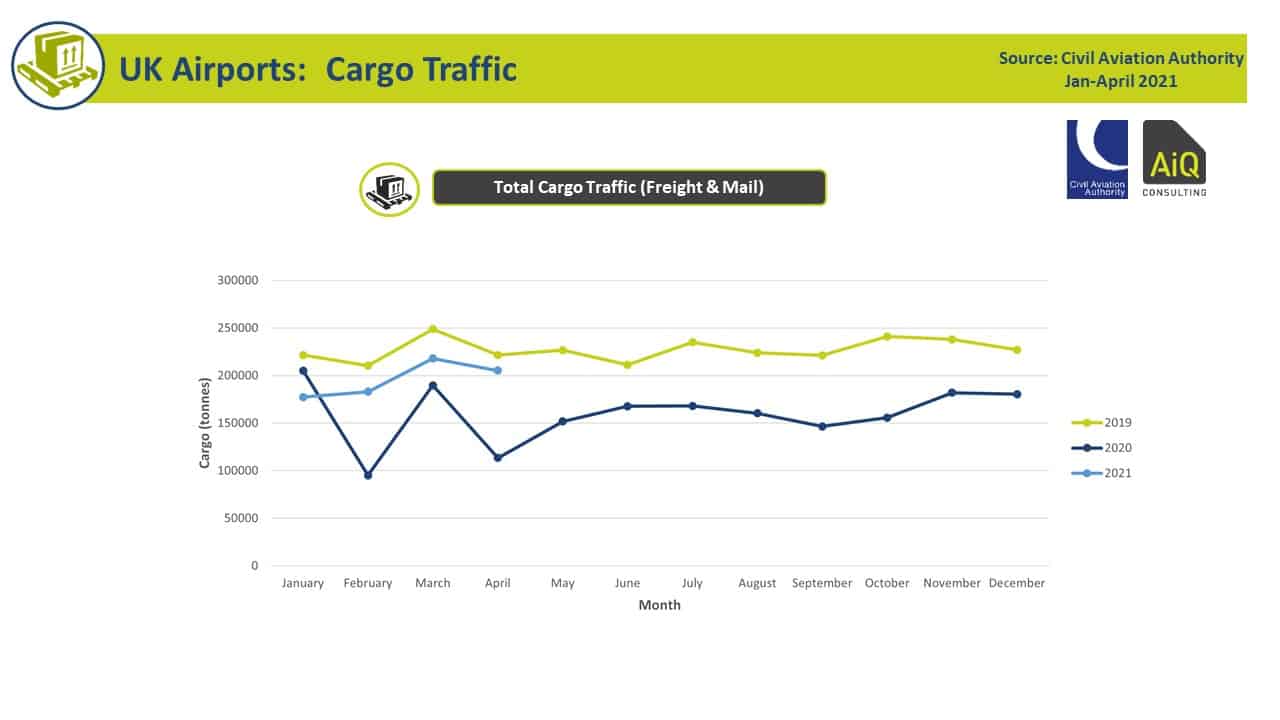

UK Airport Cargo Traffic Jan- April 2021

The plotted line graph of cargo activity inclusive of freight and mail shows a more positive pattern than that of ATMs and passenger numbers in Q1 2021 and certainly a more positive situation than 2020. View detailed graphs of Cargo activity in 2020 here. However, the graph visual shows that cargo activity is still impacted by the pandemic with a 15% reduction in cargo tonnes in Q1 2021 in comparison to Q1 in 2019. This underlines how a lack of flights impacts UK trade with the rest of the world.

2021 Airport Recovery

During Q1 2021, vaccinations were successfully rolled out in the UK and COVID levels reduced, providing hope for a restart and recovery for the aviation industry. Unfortunately, this was not soon enough to assist airport recovery in Q1 with activity levels dramatically lower than 2019. As John Holland-Kaye, Heathrow CEO comments regarding Heathrow’s Q1 figures ‘These results show how COVID has devastated the aviation sector and British trade.’

The UK’s summer economic recovery is resting on the UK governments international travel traffic light system which commenced in May. While underlying demand for travel remains strong, the government’s overly cautious approach to reopening international travel is posing a risk for a successful summer recovery.

On a positive note, the global pandemic has given many people a growing desire to ‘escaping’. Whilst the aviation industry remains in an uncertain period, the desire to fly provides much hope for a thriving recovery in the future which airports need to prepare for.

Flexible Airport Planning

Passengers are ready to fly. As the UK government introduces more countries on the green lists, airports need to be ready with their airport operational planning. To build back better, airports need adaptability and efficiency to build a sustainable airport future. Efficiently scaling up infrastructure, people and resources as travel resumes are critical for airport recovery.

Using our Airport Recovery Tool ARTΔ, AiQ operational experts assist airport managers with fast and accurate analysis across the entire airport to make smart operational decisions. ARTΔ enables airport planners to use flight schedules to provide a clear holistic vision of 18 airport processes to rapidly determine and optimise passenger, baggage, and cargo flows, resource, and equipment. To find out how AiQ can help your airport operational planning to scale up when the time comes, contact us here.